Decode The Market

Decode The Market

Retail vs Whale: Stop Trading Blindly. Get the Institutional Edge.

For too long, retail has been fodder for institutional players. We reverse that. Our platform consolidates 10+ years of market knowledge into a single, automated intelligence feed that combines technical certainty with real whale flow data. Launching Q1 2026.

The Core Problem We Solve: FOMO and Data Overload

- **Filter the Noise:** Automated multi-indicator scanning across 50+ assets prevents analysis paralysis.

- **Confirm Conviction:** Whale intelligence exposes the direction of smart money, validating your trade thesis.

- **Act Instantly:** Custom, low-latency alerts ensure you capitalize on true opportunities before the crowd reacts.

System Benefits (Trader Focus)

Time Efficiency: Automatic filtering saves hours of manual charting per day.

Exit Strategy: Use whale accumulation/distribution to set precise profit targets and stops.

Core Platform Features

Real-time Indicator Alerts

Stop watching charts. Custom RSI thresholds, EMA cross detection, MACD crossovers, Bollinger Band touches, and volume spikes are scanned continuously across all pairs and timeframes.

Hyperliquid Whale Tracker

Track on-chain trader profiles: equity, PnL, leverage, and recent fills. Get alerts when high-value wallets accumulate or exit, giving you a behavioral edge.

Combined Confidence Scoring

We use a weighted, multi-indicator scoring algorithm to merge signals. This prioritizes setups that align with market structure and institutional flow, filtering out noise.

Actionable Signal Feed (Execution Priority)

Coin Overview (Top Whales)

Visual Intelligence: Get the Full Picture

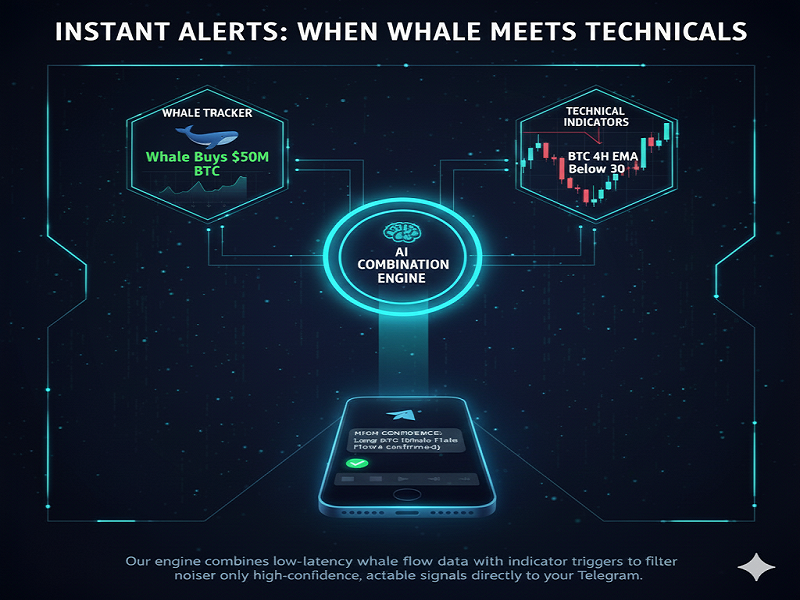

Instant Alerts: When Whale Meets Technicals

Our engine combines low-latency whale flow data with indicator triggers to filter noise and deliver only high-confidence, actionable signals directly to your Telegram.

A Behavioral Edge: Outsmarting the Herd

We use data directly sourced from platforms like **Hyperliquid** to track the movements of the largest, highest-leverage wallets. This is not guesswork; this is verifiable on-chain data. By aligning your technical signals with the direction of the market's heavy hitters, you move from speculating to investing with conviction.